Wealth platform for banks

Our wealth platform is an advanced digital workspace intended for Advisors and RMs. It streamlines the investment process end-to-end and gathers all the data for clients, portfolios, products, bank views, recommendations, markets, and risks in one place.

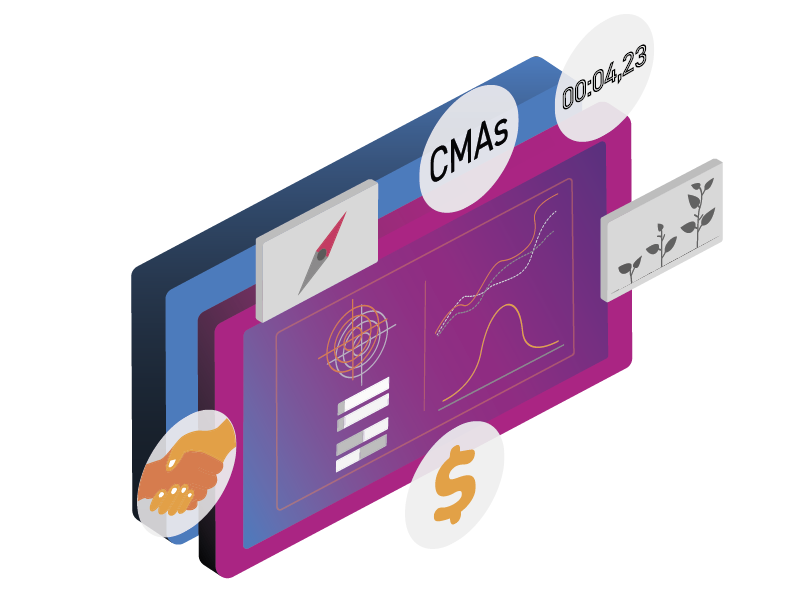

The platform makes it possible to efficiently generate investment proposals that align with client goals and preferences, bank views, and regulatory requirements, containing all the necessary information, including pre-trade analysis.

Banks use Evooq's wealth platform to gain efficiency, reduce operational costs and risk, and provide highly personalized investment services to a broader range of clients with scale.

With Edgelab's Risk engine embedded, the Wealth platform gives Advisors an in-depth understanding of the risks and exposures of the portfolio. It assesses the impact of any portfolio simulations before it gets proposed to investors or implemented.